INDUSTRY ANALYTICS - TECHNOLOGY SERVICES

The Technology Services sector—accounting for 2.3% of total employment in Philadelphia—includes a range of core industries in software and hardware services, telecommunications, e-commerce, and biotechnology. The core industries draw from the definition used by CompTIA, the tech industry trade group.

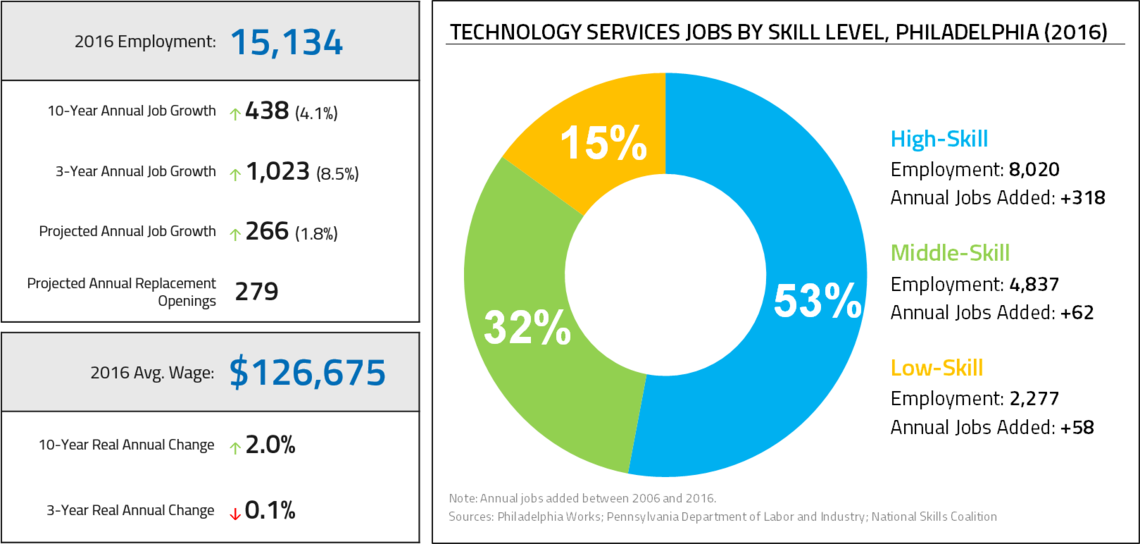

Despite being the smallest of the target sectors in the city—supporting 15,000 jobs—Technology Services has grown faster than all other target sectors over the past decade and added a significant number of jobs. Since 2006, the sector has added an average of more than 400 jobs per year. Job growth accelerated rapidly during the past three years, adding more than 1,000 new jobs annually since 2013. At $126,000, the average wage in Technology Services is the highest among target sectors and more than double the average wage in Philadelphia. This is driven by a relatively high share of high-skill jobs (53%), though nearly one-third of jobs in the sector are middle-skill jobs.

Job growth has been concentrated in subindustries such as biotechnology, computer systems design, computer programming services, and internet publishing, which collectively added 470 jobs annually during the past decade. Employment in the largest subindustry—wired telecommunications carriers—has declined, as have jobs in accompanying large middle-skill occupations in telecommunications installations and repair. At the occupational level, high-skill occupations such as software developers and systems analysts saw the largest growth, and middle-skill occupations, such as computer support specialists, saw modest growth.

- The Technology Services sector is the second-smallest target sector in Philadelphia, supporting 15,000 jobs.

- High-skill jobs account for the majority of sector employment, with middle-skill jobs accounting for one-third of employment; however, job growth during the past decade was largely concentrated in high-skill jobs.

- Employment in this sector increased markedly during the past decade, growing by an average of 4.1% per year in Philadelphia—double the national rate.

- During the past three years, the pace of hiring has accelerated quickly in Philadelphia, with average annual job growth of 8.5% since 2013, representing 3,100 net new jobs.

- While employment increased rapidly in the city during the past decade, employment at the metro level was flat.

- The concentration of Technology Services employment in the city is relatively low compared to the national average, but has increased over the past decade.

- At $126,700 in 2016, the mean annual wage for Technology Services jobs in Philadelphia is the highest among target sectors.

- The average tech services wage in the city grew by 20% in real terms over the past decade, though it remains slightly lower than metro area and national averages.

- Wage growth in the sector has stalled in recent years, however, remaining nearly flat in the city between 2013 and 2016.

- The pace of hiring is projected to decelerate through 2024, with the projected 1.8% annual growth rate in Philadelphia matching the national average. This rate is still well above overall employment growth projections in the city.

- Projections indicate that approximately 2,100 net new jobs will be added through 2024—an average of 270 jobs per year.

- The sector is projected to have 279 replacement openings annually through 2024.

- Wired Telecommunications Carriers account for nearly 30% of jobs in this sector, though this subindustry has not been a driver of growth.

- The four next-largest industries in the sector–Biotech R&D, Computer Programming Services, Computer Systems Design Services, and Internet Publishing and Broadcasting–experienced substantial growth over the past decade, adding a combined 4,700 jobs in Philadelphia.

- Employment in Electronic Shopping, while small in scale, has expanded rapidly, from 50 jobs in 2006 to 480 jobs in 2016.

- Software Application Developers, Computer Systems Analysts, and Computer Programmers added the most jobs in the sector over the past decade. All are technical computer occupations that formally require a Bachelor’s degree.

- Computer User Support Specialists and Customer Service Representatives—which both require less than a Bachelor’s degree and pay above typical wages for jobs of comparable skill levels—also grew over the past decade.

- Other notable occupations that have grown and require less than a Bachelor’s degree are Office Clerks, Sales Representatives, and Web Developers.

- Line and Equipment Installer jobs—high-paying, middle-skill positions with median annual wages near $60,000—declined slightly over the past decade, consistent with employment losses in the telecommunications industry.