INDUSTRY ANALYTICS - HEALTHCARE

The Healthcare sector—accounting for 21.3% of total employment in Philadelphia—includes core industries such as hospitals, physicians’ offices, home health care services, and nursing care facilities. The sector also includes industries that are part of the supply chain or end-product delivery, such as medical equipment wholesalers, optical goods stores, and health and personal care stores.

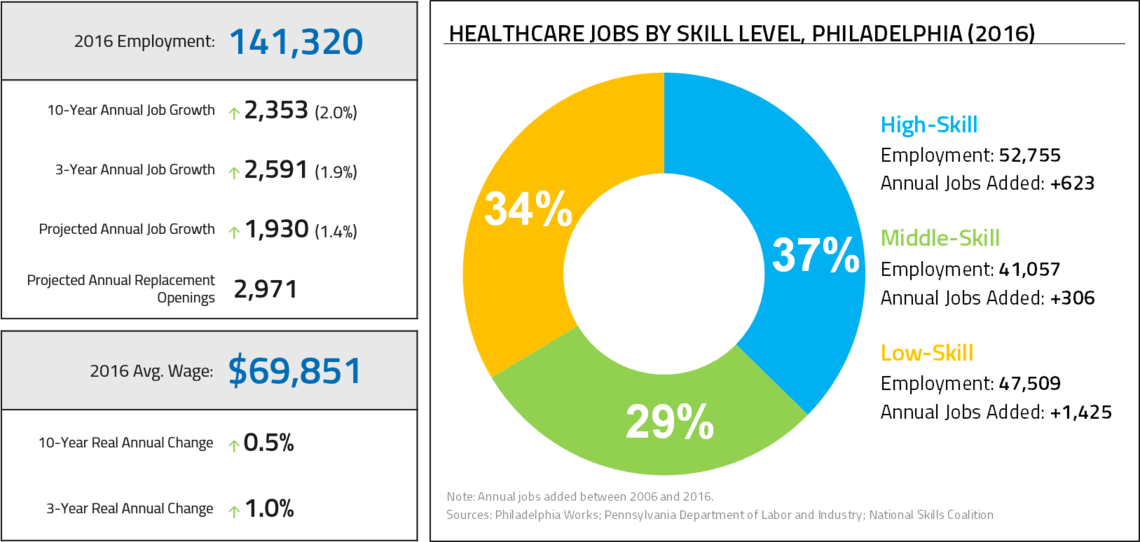

With more than 140,000 jobs in Philadelphia, Healthcare is the largest of the target sectors. It also added the most jobs among target sectors in recent years with an annual average of 2,400 new jobs since 2006. At $70,000, the average annual healthcare salary is more than 12% higher than the average salary in Philadelphia. The sector supports a balanced mix of jobs by skill level, with middle-skill jobs accounting for 29% of all jobs in the sector.

Job growth in the largest subindustry, general hospitals, has been sluggish during the past decade, with the fastest growth in services for the elderly and disabled. With the expansion of the services for the elderly and disabled subindustry, the sector has seen a surge in job growth in several low-skill, low-paying occupations such as personal care aide and home health aide, which together added more than 1,100 jobs annually during the past decade. At the same time, Healthcare also added the most middle-skill jobs among target sectors in recent years, with occupations such as nursing assistants, vocational nurses, and medical assistants experiencing modest growth. The largest occupation—registered nurses—accounts for more than 21,000 jobs in the city and has added more than 200 jobs annually since 2006.

- The Healthcare sector is the largest target sector, employing 1 in 5 (21%) workers in Philadelphia.

- Employment is spread relatively evenly across skill levels, but the bulk of new job growth during the past decade was concentrated in low-skill jobs.

- During the past three years, employers in this sector added a total of 7,800 net new jobs, or 2,600 (2.0%) per year.

- This pace of growth in healthcare slightly lagged the metro area and the nation over the past decade, but outpaced growth in the overall Philadelphia economy, in which employment increased by 0.5% during the past decade.

- The concentration of Healthcare employment in the city is high compared with the nation, but declined slightly since 2006.

- The mean annual wage for Healthcare jobs in Philadelphia was $69,900 in 2016—12% higher than the average city wage of $62,600.

- The average wage for healthcare jobs in Philadelphia is higher than at the metro, state, and national levels.

- Over the past decade, wages increased by an annual average of 0.5%, exceeding metro, state, and national growth rates.

- Wage growth accelerated in Philadelphia in recent years, averaging 1.0% annually between 2013 and 2016.

- Sector employment growth in Philadelphia is projected to average 1.4% annually through 2024, a full percentage point slower than the national average during the forecast period.

- Although the pace of hiring is expected to moderate, projections estimate that approximately 15,400 net new jobs are expected in Philadelphia through 2024—an average of 1,900 jobs per year.

- Annually, an estimated 2,971 replacement openings are projected through 2024.

- General & Surgical Hospitals provide nearly one-third of jobs in the sector (44,500), but annual employment growth over the past decade has been sluggish at 0.3% (125 new jobs per year).

- Job growth at Specialty Hospitals has been more robust (2.4% per year since 2006, or 255 jobs per year), but the employment base of 13,200 is only 30% of employment at General & Surgical Hospitals.

- The fastest growing subindustry is Services for Elderly & Persons with Disabilities, which added nearly 1,400 jobs per year during the past decade.

- However, this subindustry has the third-lowest average wage of all healthcare industries at $31,000 and employment is particularly fragmented, with 18,000 employees spread across 6,000 establishments.

- Home Health Care Services added the second most jobs in the sector during the past decade.

- Nursing Care Facilities was the only large subindustry to shrink since 2006, losing an average of 57 jobs per year (-0.7%).

- Personal Care Aides and Home Health Aides are among the largest and fastest-growing occupations in the sector, and while both have low education requirements, wages are also low.

- These two occupations account for 22,000 jobs combined, and employment in both occupations doubled since 2006.

- Nursing Assistants, Vocational Nurses, and Medical Assistants receive higher pay, but there are fewer of these jobs and employment growth has been slower.

- Registered Nurses represent the largest occupation in the sector, with 21,000 jobs in 2016—up by 2,000 since 2006.