INDUSTRY ANALYTICS - CONSTRUCTION & INFRASTRUCTURE

The Construction & Infrastructure sector—accounting for 3.2% of total employment in Philadelphia—includes all traditional construction industries as well as a range of related industries that are part of the supply chain, end-product delivery, or which provide critical support services for construction and infrastructure work. Examples of additional industries include cement manufacturing, home centers, and architectural and engineering services.

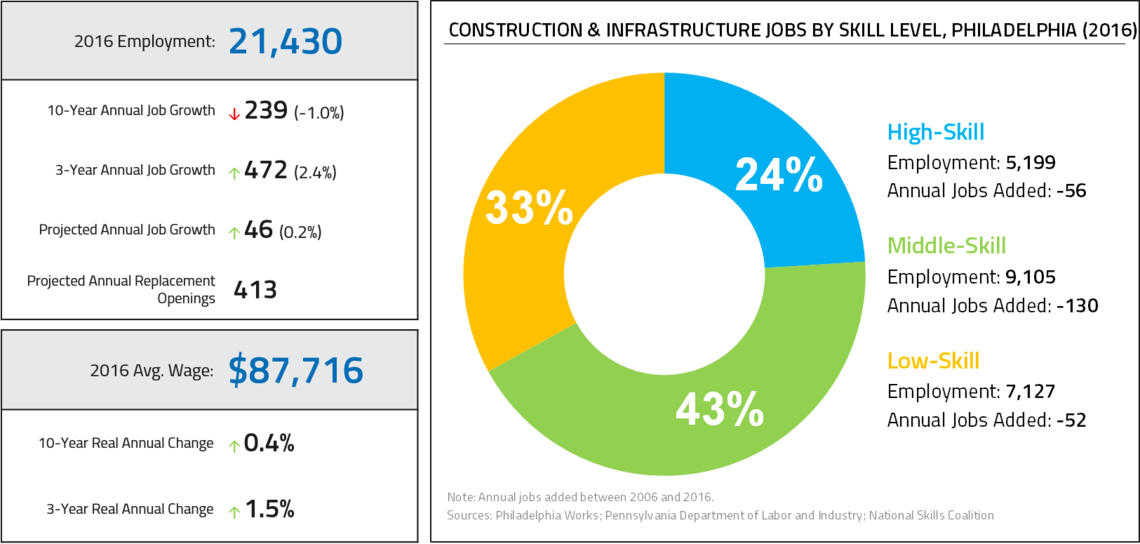

Construction & Infrastructure is the second-smallest target sector in the city, supporting 21,000 jobs. On average, these jobs pay well—at $87,000 per year, Construction & Infrastructure is the third-highest paying of target sectors. More than two out of five jobs (43%) in the sector are middle-skill. As the sector most directly affected by the collapse of the housing market and the Great Recession, Construction and Infrastructure experienced job loss over the past decade, shedding an average of approximately 240 jobs per year since 2006. Employment has rebounded with the resurgence of development activity in the city, with employers adding an average of just over 470 jobs per year since 2013.

During the past decade, the largest subindustries—plumbing and HVAC contractors, engineering services, and architectural services—all saw job losses, although general contractor subindustries expanded modestly despite the impact of the recession. Employment in the majority of occupations—70% of which are available with less than a Bachelor’s degree—declined during this period, with sizeable middle-skill occupations such as plumbers, electricians, carpenters all experiencing net losses. Construction laborers, one of the better paying low-skill occupations, grew slightly during the past decade.

- The Construction & Infrastructure sector is the fifth-largest target sector in Philadelphia, supporting approximately 21,400 jobs in 2016.

- Employment has still not recovered to the 2006 levels, as this sector was among the most directly affected by the housing market collapse and subsequent Great Recession.

- Middle-skill jobs account for a relatively high share of sector employment (43%), but 54% of sector job losses during the past decade were concentrated in middle-skill jobs.

- The decline in Construction & Infrastructure employment over the past decade, averaging -1.0% annually, was slightly less severe in Philadelphia than in the metro area and nation.

- Hiring picked up substantially during the past three years, as firms added a total of 1,400 net new jobs—an average of 472 jobs per year.

- Even as the pace of hiring accelerated in the past three years, sector employment growth in Philadelphia lagged the than the national average by more than a full percentage point.

- Construction & Infrastructure employment in Philadelphia is significantly less concentrated than the national rate; sector concentration at the metro level is closer to the national average.

- The mean annual wage for Construction & Infrastructure jobs in Philadelphia was $87,700 in 2016, up from $84,000 (2016 dollars) in 2006 and considerably higher than the mean annual wage for the sector at the metro, state, and national levels.

- Over the past decade, however, wage growth in the city was slower than metro, state, and national rates, at an average of 0.4% per year.

- During the past three years, average annual wage growth accelerated to 1.5%, but still lagged metro, state, and national rates.

- Projections anticipate that hiring will slow markedly through 2024, expecting an average of just 46 new jobs per year for a total of 370 net new jobs over the next eight years.

- Employment growth in Philadelphia (0.2% per year) is projected to lag behind metro, state, and national rates through 2024.

- The sector is projected to have 413 replacement openings annually through 2024.

- Large construction subindustries—including Plumbing & HVAC Contractors, Commercial Building Construction, Electrical Contractors, and Residential Remodelers—account for 30% of sector employment, or 6.400 jobs.

- Architectural Services and Engineering Services make up 23% of sector employment (4,900 jobs), but the subindustries collectively lost an annual average of 66 jobs since 2006, and decline is projected to continue.

- General contractor industries expanded (+75 jobs per year) over the past decade, despite the impact of the recession.

- Employment in the majority of occupations in this sector declined over the past decade.

- A notable exception was Construction Laborers, the largest occupation in this sector (1,800 jobs); although it added only 9 jobs per year during the past decade, it was one of few industries not to contract during that time

- The majority of occupations and nearly 70% of all jobs in this sector are available with less than a Bachelor’s degree.

- With significant employment in middle-skill occupations, wages are typically higher than the citywide overall median wage.