Institutional Spend and the Potential for Small & Diverse Business Recovery after the Pandemic

Eds-and-Meds Spending is Large, but More Could be Localized

According to data compiled and analyzed by the City Controller’s Office in 2015, the 34 universities and hospitals located in Philadelphia collectively spend roughly $5.3 billion on goods and services annually, but—at least in 2014—nearly half of these dollars were spent outside of Philadelphia. Analysis of the local business landscape suggests that at least $530 million of the dollars spent by these eds-and-meds “anchor” institutions currently being spent outside of the region align with the capacity of the local market, at least when considered by industry category codes. Much research has been done on the gaps between supply and demand, and the general conclusion is that there are significant barriers to access to institutional supply chains for local suppliers, especially businesses owned by people of color; these barriers include information asymmetries, reified supply chains, insufficient technical capacity on the part of small firms, and lack of access to the appropriate forms of capital necessary to achieve the requisite scale to efficiently do business with large institutions.

The founding premise of the Economy League’s Philadelphia Anchors for Growth & Equity (PAGE) initiative is that the region’s anchor institutions can gradually adjust their supply chains to be more accommodating to local and diverse firms when these anchors intentionally collaborate to use their dollars to spur local business and job growth. The ultimate goal is to create cohorts of growing local firms that export goods and services and import dollars - in addition to our existing cohort of supply chain leaders from major eds-and-meds institutions that are committed to this work. It should be noted that anchor-led economic development is a “Made in PHL” idea; the University of Pennsylvania is widely credited as among the first institutions to create a “live, buy, hire local” campaign and to generally deploy its economic power to create what Harvard Business School’s Michael Porter calls “shared value” in its surrounding communities. Other Philadelphia institutions, such as Drexel University, Children’s Hospital, Jefferson Health, and Temple University and Health, developed similar programs; not coincidentally, these organizations are founding partners in the PAGE initiative.

PAGE uses a three-pronged approach to a chieve its aim: 1) Analyzing institutional purchasing data to identify ‘opportunity spaces’ for localization and diversification, and then translating these into real contract opportunities; 2) Engaging major supply chain integrators, such as Aramark, Office Depot, Thermo-Fisher, and hospital GPOs in local purchasing efforts; and 3) Working with institutional procurement directors to reduce barriers to access for local businesses by changing policies and creating systems to connect small, local businesses to supply chain opportunities at large universities & hospitals.

In short, there is a strong case to be made that building the capacity of local and diverse suppliers, so they can better compete for contracts with institutional purchasers, can provide a significant boost to the local economy (in fact, the Economy League has proposed the creation of such a program called PAGE Procurement Prep.). Research suggests that capturing just 25 percent of this half-billion-dollar opportunity locally would translate into 1,250 new manufacturing jobs and 4,000 indirect jobs in Philadelphia. In this Leading Indicator, we draw upon data collected by the Economy League and others to examine the landscape of suppliers already utilized by the city's eds-and-meds anchor institutions and compare this with more general data on the region’s suppliers to point toward strategies on how more businesses can grow with more local-investment opportunities.

Supply and Demand Landscapes

In 2019, with support from JP Morgan Chase, the Economy League compiled a database of every city-based supplier utilized by at least one of the city’s major eds-and-meds anchor institutions. These data, provided to the Economy League by the anchor institutions themselves, included information about annual business revenues as well as various certifications (Minority-owned Business Enterprise, Woman-owned Business Enterprise, etc) and formed the basis of a report that analyzed in detail how anchor dollars are spent locally.

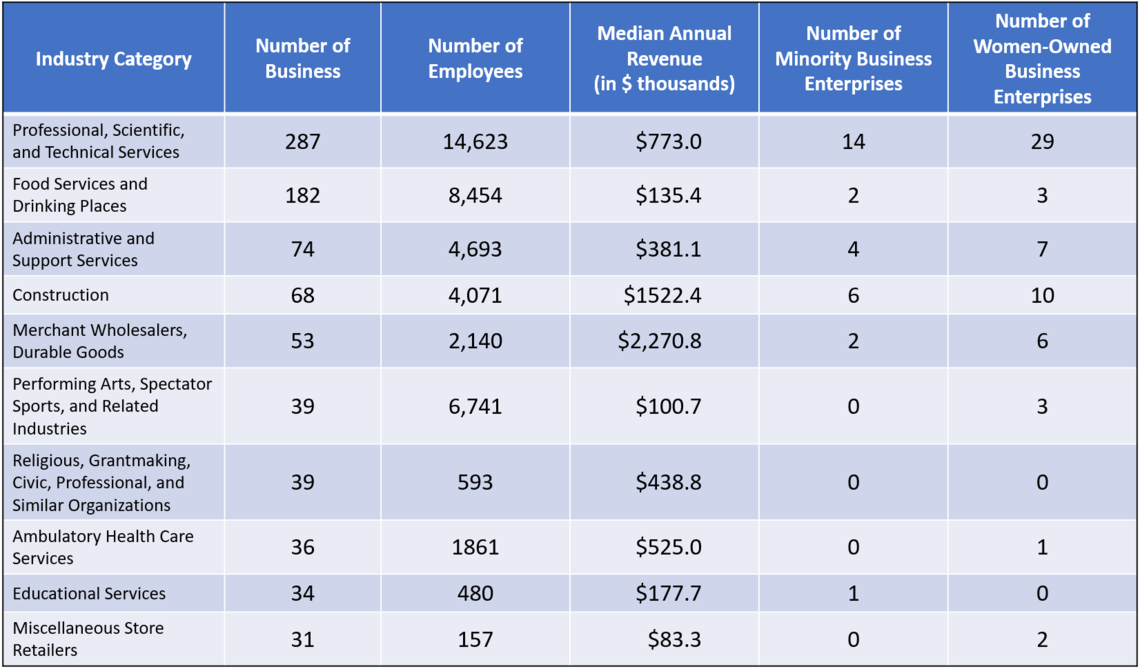

The PAGE database contains about 1,400 firms. Figure 1 below presents data on the top ten supplier industries, by number of businesses that have worked with at least one of the anchors that participate in the PAGE initiative, as well as revenue and certification information. These data reveal that roughly 15 percent of professional, scientific & technical service providers utilized by these institutions are certified as Minority- or Woman-owned Business Enterprises, that 23.5 percent of construction firms are M/WBE certified, as are 15 percent of merchant wholesalers.

FIGURE 1

NOTE: Data for this table were obtained from the Economy League of Greater Philadelphia’s PAGE Supplier Database.

Figure 2 shows the concentration of these supplier businesses by ZIP Code and City Council District. While many of these suppliers are in the Center City and University City neighborhoods (due to the high concentration of office and retail space), however a significant number of suppliers surround the downtown areas in zip codes with larger concentrations of Non-Hispanic white residents. While it is important that anchor institutions are utilizing the services and products of local businesses, more can be done for minority-owned businesses in other sections of the city.

FIGURE 2

NOTE: Data for this table were obtained from the Economy League of Greater Philadelphia’s PAGE Supplier Database.

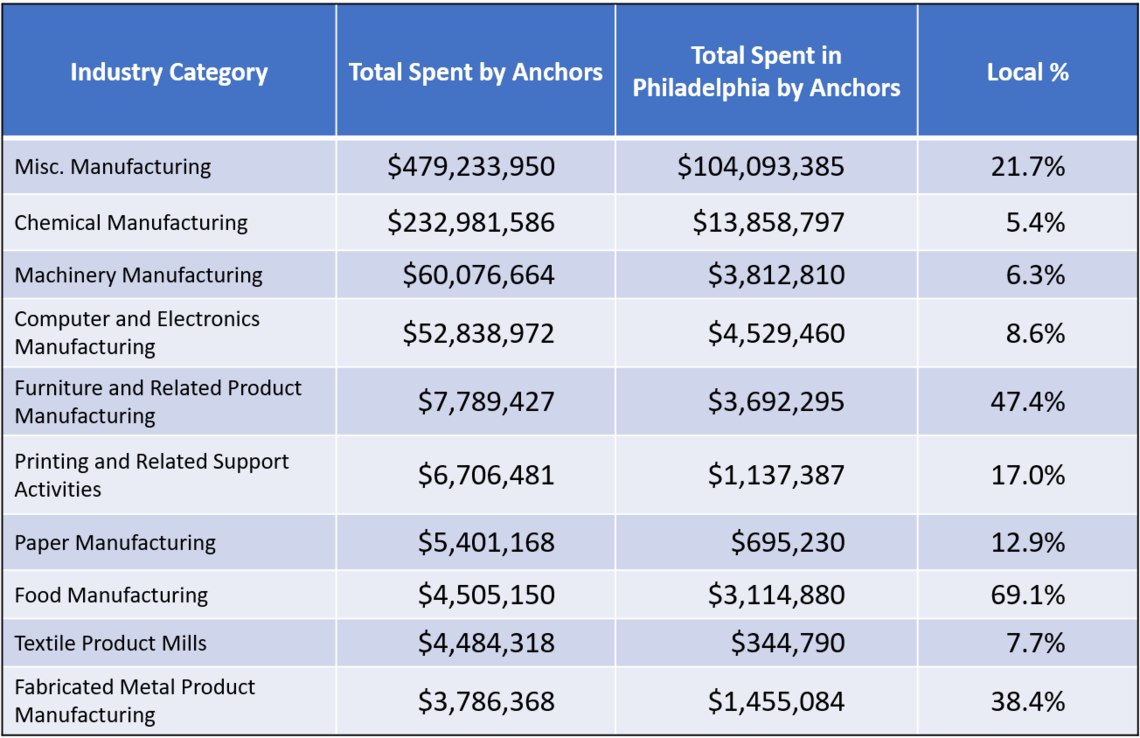

While Figure 1 and 2 demonstrate the landscape and concentration of supplier, Figure 3 demonstrates that this supply mismatches recent anchor spending demand. According to the 2015 analysis from the City Controller’s Office, many manufacturing industries within the city lack the capacity to meet the demands of the local anchor institutions – thus the anchors look for business opportunities outside of the city. Chemical manufacturing is a prime example. As of 2015, only 5.4 percent of anchor spending on chemical manufacturing came from Philadelphia firms. Yet the city currently has 43 chemical manufacturing firms operating within the city (five of which are represented in the PAGE supplier landscape data) [1]. Thus, 38 firms have the opportunity to compete for the remaining $232,981,586 spent outside of the city. With more programming devoted to building local firms’ capacity to bid and compete for anchor contracts, this money will no longer be funneled away from the local economy.

FIGURE 3

NOTE: Data for this table were obtained from the City Controller’s Office of the City of Philadelphia’s 2015 Anchoring Our Local Economy: Developing a Local Procurement Strategy for Philadelphia’s Higher Education and Healthcare Institutions report. The original table can be found on page 18.

Toward an Equitable Post-Pandemic Philadelphia

As we have demonstrated elsewhere, small and minority-owned businesses are bearing the brunt of the COVID-19 pandemic; if we do nothing differently, Philadelphia’s business ecosystem and overall economy will be less diverse and equitable than before the crisis. The time is now to plan to capitalize on the opportunity presented by the post-pandemic recovery phase. Philadelphia’s robust sector of anchor institutions, such as hospitals, universities, utilities, sports teams, and headquartered major corporations has helped lift the region out of every downturn in the past 50 years. How they spend money in the immediate aftermath could be the linchpin of an equitable post-pandemic economy. Though much of this business activity is currently on pause, Philadelphia’s anchor institutions and broader economy will soon begin to “re-open” and resume spending, purchasing and powering the local economy.

A small and diverse business development strategy must be one of the foundational pillars not just of equitable recovery for Philadelphia but for building a more resilient region for the future. The pandemic has exacerbated preexisting inequities and inequalities, but it has also revealed fundamental weaknesses in institutional supply chains. An anchor-led small business development strategy can be deployed now to prepare Philadelphia’s small and minority-run businesses to meet anchor demand as the economy reboots. We can provide a lifeline for small business, put Philadelphians back to work, and help shape a more equitable post-pandemic Philadelphia.

However, the region lacks a robust pipeline of local, diverse businesses with the capacity to serve major institutions. Despite the best of intentions on the part of our institutions, without a base of local businesses ready to meet anchor demand, Philadelphia will never be able to fully capture the available opportunities. As we argued in a piece in Billy Penn recently, we need a program specifically targeted toward providing minority-owned businesses the tools they need to thrive in institutional supply chains. In addition, to enable MBEs to grow, we need to create access to equity capital. The Economy League is working with partners to create programs for address both of these challenges.

Works Cited

[1] Bureau of Labor Statistics, U.S. Department of Labor. 2019. “Series ENU42101205325, Number of Establishments in Private NAICS 325 Chemical manufacturing for All establishment sizes in Philadelphia County, Pennsylvania, NSA.” Quarterly Census of Employment and Wages. Retrieved from: (https://www.bls.gov/data/).